Este grupo que comienza en marzo será exclusivamente en inglés. Si está interesado/a en participar en este curso en español, por favor comuníquese con Ana Fernandez Frank ana@efaa.org para información sobre otros grupos que estarán comenzando en español

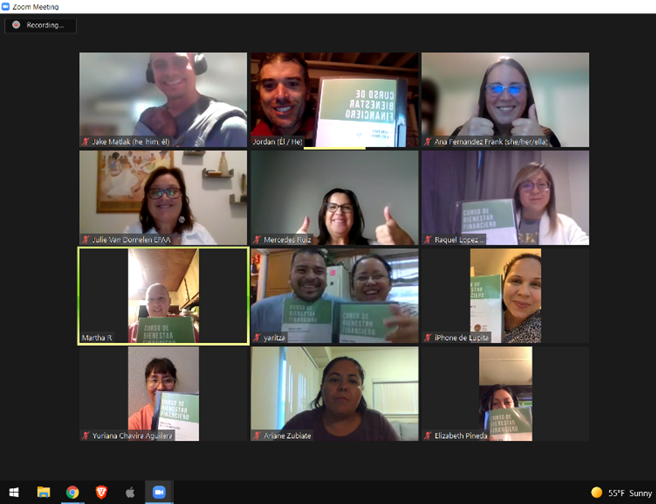

From August to October 2021, EFAA hosted Philanthropiece Foundation for the first-ever Financial Health Course. This customized 8-week course supports participants in creating a culture of savings, understanding systemic barriers to building wealth, and connecting to equitable resources to support their financial wellbeing. This first course was delivered virtually, and it included 11 Spanish speaking participants. 100% of the graduates reported that they made progress towards their financial goals due to the course and learned something new.

Now EFAA is getting ready to start our first English cohort. Will you join us?

Here’s what you need to know:

Date: Wednesdays from March 30th to May 18th 2022

Time: 6pm to 7.30pm

Place: on Zoom

Cost: Free!

Register HERE.

Questions? Contact us!

If you need support with computers or connectivity, help is available.

Jordan Bailey – jordan@philanthropiece.org – (303) 522-6806

Ana Fernandez Frank – ana@efaa.org – 720.310.0719

Course Overview

Week 1: Establish financial goals and culture of savings

Week 2: Friendly Banks and LaMedichi (Savings tool APP)

Week 3: Personal values & managing money, tips for saving

Week 4: Taking action towards my goals

Week 5: Credit and loans

Week 6: (TBD: Participants choice)

Week 7: (TBD: Participants choice)

Week 8: Resources, recognition and celebration

“I was a person who never saved. I was someone who wasted a lot of money; at the end of the quincena I would have no funds left and I would have to go around asking for money from my parents or my siblings. This course has served me greatly. For example, now I have three months saved up. I have learned to not spend on things that I don’t need; and to have saved a bit of the money that I earn for anything that comes up that is urgent or extra, that is needed for my kids or myself.”