FILING YOUR TAXES IS EASIER THAN YOU THINK!!

FREE tax preparation for households of less than $58,000

Tax Information: The deadline to file your 2021 taxes is Monday April 18th 2022, and EFAA wants to make sure that all our participants are aware of the tax credits they might be eligible for. Even if you earn little to no money, by filing your taxes you could receive valuable tax refunds that can help you pay for groceries, rent, clothes, childcare, or even to start a savings fund.

aware of the tax credits they might be eligible for. Even if you earn little to no money, by filing your taxes you could receive valuable tax refunds that can help you pay for groceries, rent, clothes, childcare, or even to start a savings fund.

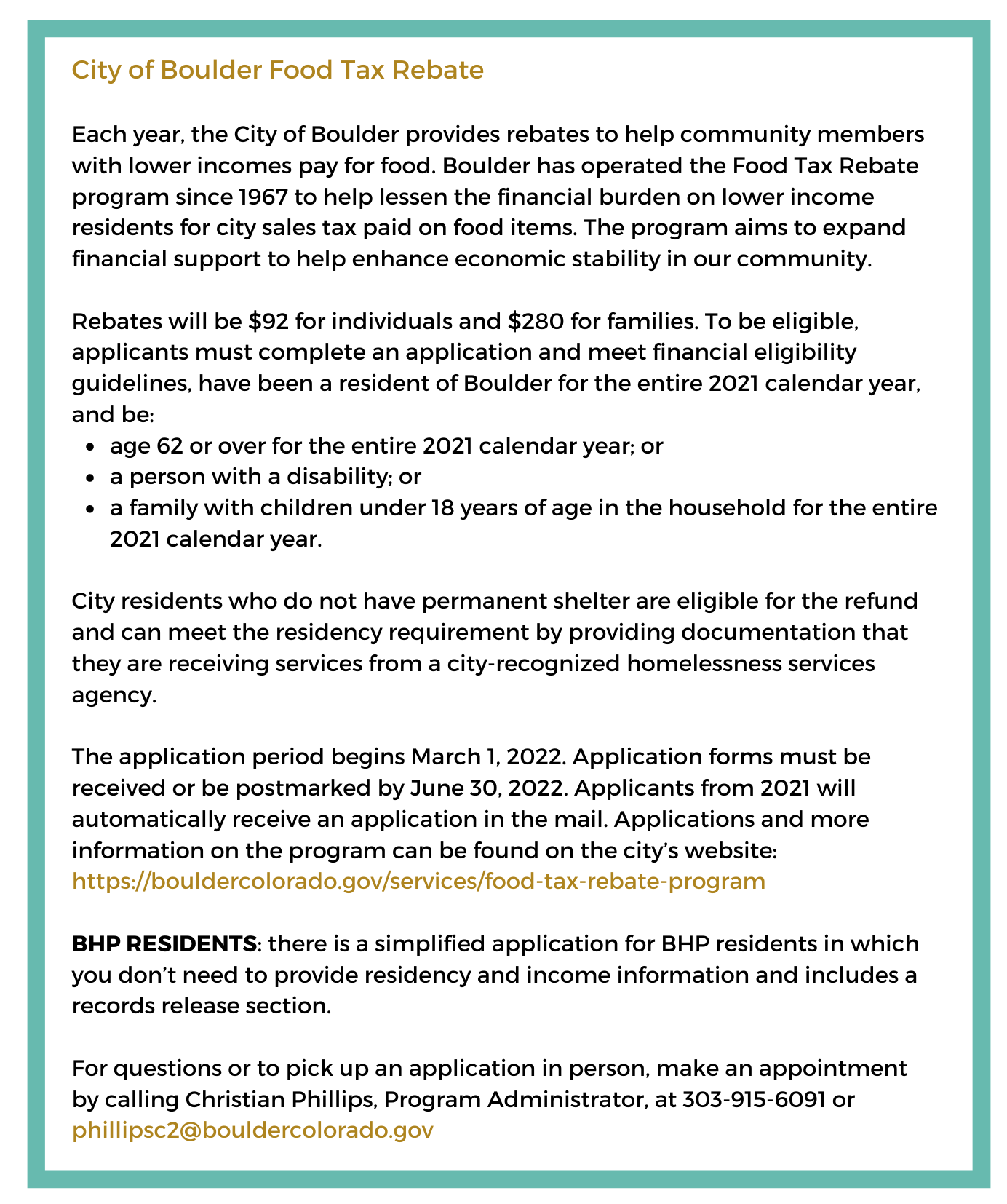

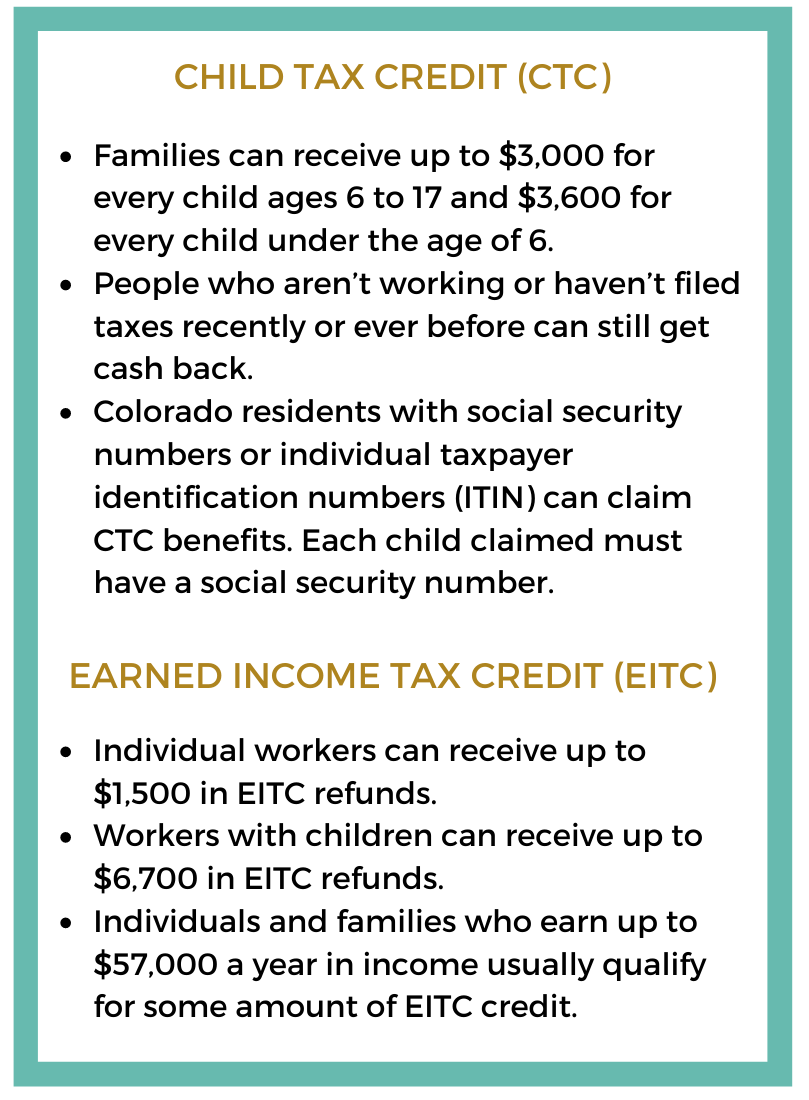

Earned Income Tax Credit and the Child Tax Credit refunds are available to people like you who are building a better future for themselves and their families (see side box). In addition, the application for the City of Boulder Food Tax Rebate is now open. See below for more information about eligibility and how to access this rebate.

EFAA is hosting a CRC Tax Outreach Ambassador outside of our Food Bank from March until mid-April to provide information to participants and answer questions. Stop by their table and get your questions answered! You can even book your appointment to get help filing your taxes (see below).

Tax Preparation Help: In addition Emergency Family Assistance Association (EFAA) is partnering with Boulder Public Library (BPL), Tax Help Colorado, and Community Resource Center (CRC) to provide FREE, high-quality tax preparation to households that earned less than $58,000 in 2021. IRS-certified tax preparers will be at BPL’s Main Library (1001 Arapahoe Ave, Boulder, CO 80302), Boulder Creek Room, on Tuesdays from 3–6:30 p.m. and Saturdays from 10:30 a.m.–3 p.m. beginning the week of March 15 through April 16. Don’t miss a chance to claim a tax refund!

Sign up for your appointment now: https://go.oncehub.com/TaxHelpBPL; appointments are not required but highly recommended.

Click here for more information and a detailed list of the documents you would need to provide.

Click here for a list of Tax Preparation Help sites

Visit GetAheadColorado.org for more information